7 Growth Opportunities in China for International Consumer Brands in 2026

Introduction: The Rising Potential of China’s Market

China’s consumer market continues to evolve as a global powerhouse, presenting unprecedented opportunities for international brands. With a growing middle class and rapid digital transformation, the landscape is ripe for strategic expansion.

The luxury goods market, valued at a staggering US$91.97 billion in 2025, is projected to grow annually by 2.13% through 2030. This significant growth follows a period of decline, suggesting a robust market recovery is well underway.

In the automotive sector, China’s dominance is clear – delivering 25.57 million vehicles in 2024, representing nearly 30% of global production and firmly establishing the country as the world’s largest automotive manufacturer.

This growth is further enabled by China’s sophisticated digital infrastructure. Major cities like Shanghai are investing heavily in consumer engagement initiatives, including a 500-million-yuan consumer voucher programme and signature events such as Shanghai Fashion Week. These initiatives highlight how digital and experiential marketing are converging to drive consumer spending.

1. The Rise of Chinese Digital Marketing Agencies

Necessity in a Complex Market

International brands entering China face a fundamentally different market structure compared to Western economies. The regulatory landscape is unique, and consumer preferences are increasingly sophisticated and locally influenced.

Digital marketing agencies serve as essential intermediaries in this complex environment. They help international brands navigate regulatory complexities, understand cultural nuances, and develop effective strategies that resonate with Chinese consumers.

Strategic Value Proposition

These specialised agencies provide critical services that can make or break a brand’s success in China:

• Local regulatory compliance expertise

• Platform-specific marketing strategies

• Culturally nuanced content creation

• Consumer behaviour insights

The competitive landscape in China now includes highly sophisticated domestic brands, requiring agencies to help international companies differentiate effectively and develop tailored approaches that connect with local audiences.

With Chinese consumers becoming “more selective” in their purchasing decisions – shifting from a “you-only-live-once” mentality to “you only need one” – these agencies provide vital cultural and consumer behaviour insights that would be difficult for foreign brands to develop independently.

2. Leverage China’s Social Media Platforms

Platform Evolution and Consumer Preferences

While established platforms like WeChat, Weibo, and Douyin remain central to consumer engagement, China’s social media landscape continues to evolve rapidly. These platforms are increasingly vital for brand promotion, particularly through voucher-driven campaigns and digital marketing initiatives.

Major urban centres are specifically leveraging these platforms for integrated marketing. Shanghai’s “Shanghai Summer” International Consumption Season incorporates brand experience zones where potential customers can interact directly with products, blending physical retail experiences with robust digital components.

Content Adaptation Strategies

Success in China requires content that genuinely resonates with local audiences. LVMH’s recent expansion through “The Louis,” a ship-shaped pop-up store and exhibition in Shanghai, exemplifies this approach. The initiative became an unexpected tourist attraction, demonstrating how experiential marketing combined with physical presence can drive significant engagement.

Brands must adapt their messaging strategies specifically for Chinese platforms rather than simply translating Western content. This involves understanding platform-specific features, local trends, and cultural references that resonate with Chinese consumers.

3. E-commerce Growth and Online Presence

China’s Dominant Position in Global E-Commerce

China has firmly established itself as the world’s largest e-commerce market. Major platforms like Taobao, JD.com, and Pinduoduo continue to drive massive transaction volumes, while the integration of online platforms with offline retail—often called O2O (online-to-offline)—has become standard practice for successful brand presence.

Cross-Border E-Commerce Opportunities

The intersection of e-commerce and consumer spending campaigns creates unique opportunities for international brands. Companies can strategically align product launches with major shopping festivals and voucher programmes to maximise impact.

The Shanghai municipal government’s approach demonstrates this potential, combining voucher schemes with digital platform partnerships (specifically with Meituan, Dianping, and Tmall) to amplify brand reach through targeted digital promotions.

Export Implications

China’s sophisticated e-commerce infrastructure also serves as a powerful export base. International manufacturers are increasingly using their Chinese operations and e-commerce capabilities to reach global markets, with China’s vehicle exports reaching 5.5 million units in 2024 and projected to exceed 7 million by the end of 2025.

4. AI-Driven Insights for Market Optimisation

Data-Driven Consumer Understanding

Understanding China’s rapidly shifting consumer preferences requires sophisticated data analysis and AI-driven insights. Chinese consumers are demonstrating evolving purchasing patterns—shifting from volume-based “you-only-live-once” consumption to more selective “you only need one” purchasing behaviours.

AI tools can help brands analyse these trends, identify emerging consumer segments, and predict future behaviour patterns that would be impossible to detect through traditional market research methods.

Trend Prediction and Localisation

The complexity of the Chinese market, with its significant regional variations in brand preferences, demands advanced analytical capabilities. In the automotive sector, for example, different regions show varying preferences:

• Southeast Asia: BYD, Geely, and Chery lead exports

• South America: BYD and Chery dominate

• Middle East: Chery leads the market

Similar regional variation exists within China itself, highlighting the need for data-driven insights for successful market segmentation and localised strategies.

5. Localised Branding and Cultural Adaptation

The Imperative of Cultural Understanding

International luxury brands are learning that success in China requires fundamental shifts in marketing approach. Richemont has observed that Chinese consumers are increasingly favouring jewellery over other luxury goods, reflecting a broader shift toward selective, high-quality purchases.

Burberry’s strategy of emphasising its “British roots” has resonated with younger Chinese consumers who appreciate “authenticity” while seeking locally relevant experiences.

Sector-Specific Adaptation

The automotive sector provides clear examples of necessary adaptations. Chinese domestic brands hold nearly 90% of the EV market, driven by advanced connected technology that appeals to younger buyers.

International automotive brands are responding by introducing new energy vehicle (NEV) models tailored to local preferences. Nissan, for example, plans to reach eight NEV models by 2026 specifically designed for the Chinese market.

Seasonal and Cultural Alignment

Beyond core branding, international brands can leverage cultural moments strategically. 2026 will be the Year of the Horse in the lunar calendar, a motif that suits the heritage of many luxury brands and creates natural opportunities for themed campaigns and collections.

Aligning product launches and marketing initiatives with the lunar calendar and local cultural celebrations demonstrates cultural awareness and creates organic connections with Chinese consumers.

Challenges and Considerations

International brands must navigate several significant challenges in the Chinese market:

• Regulatory complexities: China’s market environment is increasingly regulated, requiring dedicated expertise to ensure compliance.

• Domestic competition: Local brands now control 58% of the overall passenger vehicle market and nearly 90% of the electric vehicle (EV) market, posing strong competition for international brands.

• Consumer preferences: As Chinese consumers become more selective, understanding local preferences and staying ahead of trends is crucial.

6. Platform Diversification with Strategic Precision

While many international brands focus heavily on WeChat and Weibo, China’s digital landscape is far more dynamic and nuanced. A successful strategy requires tapping into the diverse ecosystem of platforms that cater to different audiences and content types:

- Xiaohongshu (Little Red Book) is a powerhouse for beauty, fashion, health, and lifestyle brands, offering a community-driven environment with strong user-generated content and review features.

- Douyin (the Chinese version of TikTok) resonates with Gen Z through short-form video content, seamlessly blending creativity with direct e-commerce functionality.

- WeChat continues to be indispensable for brand communications, acting as the hub for official accounts, mini-program-based e-commerce, loyalty programs, and direct, high-touch conversions.

- Bilibili captures the imagination of a tech-savvy Gen Z audience with its deep-dive content on gaming, animation, and tech, making it the go-to for niche communities.

- Kuaishou stands out in second and third-tier cities, where it’s known for its authentic, grassroots appeal and narratives that resonate with rural and regional cultures.

Each platform has its own unique algorithmic logic and content preferences. For brands to succeed, it’s essential to design tailored content strategies that speak to the specific strengths of each platform. One-size-fits-all campaigns won’t cut it.

7. Data-Driven Localization and Personalization

In China, true localization is far beyond simple translation, it’s about creating experiences that resonate with local culture and consumer behaviors. Here’s how:

- Cultural Relevance: Successful campaigns need to tap into local holidays, cultural moments (like the “mini-holidays” during the 春节 “Spring Festival”), and consumer rituals that shape purchasing behavior.

- AI Personalization: Thanks to China’s advanced consumer-data ecosystem, brands can leverage artificial intelligence to offer highly personalized experiences, mirroring the precision seen from local tech giants like Alibaba and ByteDance.

- Regional Sensitivity: A campaign that works in Shanghai might fall flat in Chengdu or Chongqing. Understanding the regional nuances in tastes and preferences and segmenting your messaging accordingly ensures deeper connection and relevance with local consumers

What International Brands Can Do to Prepare for 2026

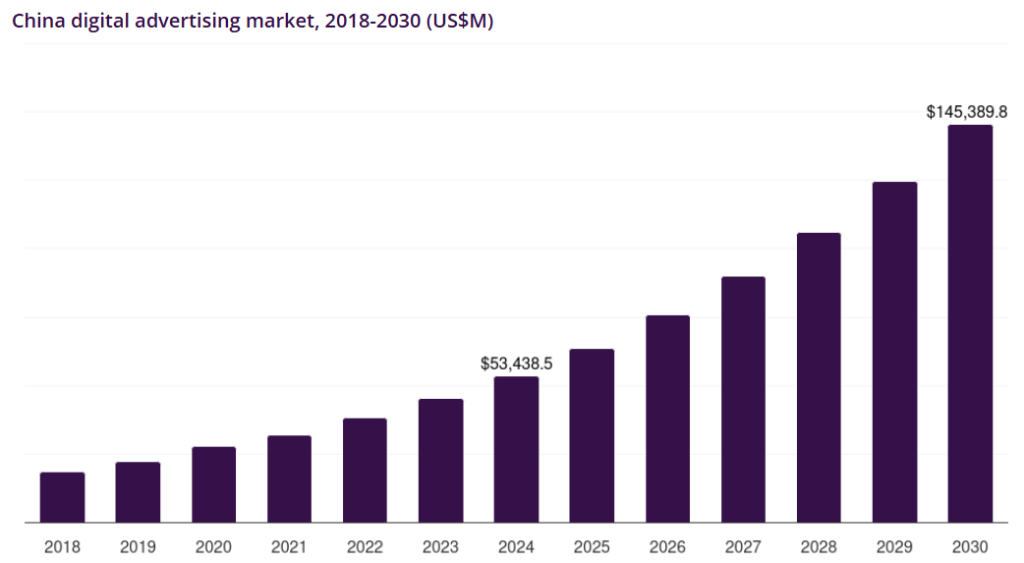

China’s consumer landscape is evolving rapidly, and international brands that prepare early will be better positioned to capture growth. The market is expected to grow at a CAGR of 18 percent from 2025 to 2030, driven by expanding digital adoption and increasingly sophisticated consumer behaviour. According to Grand View Research, China’s digital advertising sector was valued at USD 53.4 billion in 2024, reflecting the scale and momentum of the market.

This pace of change means that brands entering the market must move with clarity and local intelligence. Success will depend on adapting global strategies to local expectations, building trust on domestic platforms, and understanding the nuances of Chinese consumer behaviour.

Charlesworth brings 25 years of on-ground experience across China and APAC, supporting international brands with insight-led strategy, localisation and execution across the region’s most influential digital channels. Our expertise helps brands refine their market approach, navigate regulatory considerations and communicate with consumers in ways that build relevance and long-term loyalty.

With the right strategy and the right partner, international brands can turn the complexity of China’s market into a powerful advantage and prepare for sustainable growth in 2026 and beyond.